How to Set and Achieve Financial Goals

Learning how to set and achieve your goals professionally, personally, and financially is a valuable skill to have throughout your life. A financial goal can be short-term, mid-term, or long-term, and it is a specific objective that a person sets for spending and saving money. Achieving your financial goals can be challenging depending on your objective, but understanding how to create a realistic plan for your money can be the first step in your journey toward financial freedom.

What are Examples of Financial Goals?

Understanding the different types of financial goals can help you learn more about what to choose for yourself:

- Short-Term Financial Goals: Generally, individuals want to tackle these objectives anywhere from now to within the next year or two. Examples of short-term financial goals are saving up for a vacation, paying for holiday gifts, paying off a little bit of credit card debt, or starting to build an emergency fund.

- Mid-Term Financial Goals: Mid-term financial goals require more time and planning than short-term goals, Typically, they have a timeline of around three to five years. Some examples can include building up a credit score to 800 or paying off a car loan.

- Long-Term Financial Goals: Long-term financial goals are the pathway to larger financial milestones. Generally, a long-term financial goal is something an individual can realistically achieve over time and may take anywhere from five years to 20 years or more. Examples of long-term financial goals can be paying off a mortgage, purchasing a home, starting a business, or saving enough money for a dependent’s college education.

Now that you know more about the examples of financial goals, you can better shape your future and create more realistic objectives! When individuals have a purpose and a plan for their finances, the path to achieving these goals becomes clearer.

Set Effective and Realistic Financial Goals

Before you can set and achieve your financial goals, the first step in this process is to identify your financial priorities. Do you want to pay off credit card debt? Or do you need to create an emergency fund with at least three to six months’ worth of expenses? You can have more than one objective at a time! Using the list above, try to establish your short-term, mid-term, and long-term financial goals.

A great tool for setting goals is to consider the SMART criteria. When making SMART goals, review the following acronym and determine how these concepts can apply to your finances:

- Specific: The more specific you are with your goals, the better! Instead of just working to save money, individuals may find greater success with a more specific goal, such as saving at least $100 from each paycheck per month.

- Measurable: When it comes to your financial goals, it’s important to do some research and determine the exact numbers you need to reach to help you achieve them. For example, if you are looking to save up for a vacation, you should figure out the exact amount of money you need to save. If you want to take a vacation to an all-inclusive resort, you need to pay for your flight, hotel, tips for the staff, and any extra excursions. It all adds up!

- Achievable: What works for someone else may not work for you – it is okay to keep your goals as realistic as possible! Make sure to have accurate information about your current budget and finances to determine if your goals are achievable. For example, if you are currently struggling with a large amount of debt, it may not be realistic (or smart) to take a large trip or make a big purchase as a short-term goal. When you set financial goals, they should reflect your current financial situation.

- Relevant: Ask yourself why this goal is important to you. If you can get down to your true motivation to reach that objective, it may help you stay focused on your goals.

- Timebound: Be realistic and honest about the time required to achieve your goal. Remember that you can have multiple goals simultaneously and break them up into different categories based on the amount of time it takes to reach them!

Call Our Team

Take the first step and call our toll-free hotline to speak with a specialist.

What are the 7 Steps of Financial Planning?

You can work on your financial goals alone, but you may have the option to get professional help. Planning your finances like a pro typically means following the recommended steps created by Certified Financial Planners (CFPs). When working with CFPs you can expect the financial planning process to follow the list below:

- Asking Questions to Understand Your Current Financial Situation

- Helping You Choose Your Goals, Whether They are Short-Term, Mid-Term, Or Long-Term

- Analyze the Steps it Takes To Reach Those Objectives

- Developing Financial Planning Recommendations

- Presenting the Plans to You

- Working with You to Implement the Recommendations and Follow the Plan

- Monitoring Your Progress and Updating Your Goals as Needed

Working with an advisor can allow you to access their experience and knowledge, so it takes a little bit of the pressure off yourself during this process. Financial advisors will ask questions about your finances and personal life to better understand your relationship with money, your values, and your potential risk tolerance. Financial planning can seem like murky waters if you are inexperienced, but working with a financial planner can help you prioritize your goals and learn how to reach realistic objectives.

How Do You Achieve Your Financial Goals?

Depending on your objective, achieving your financial goals can be as simple as creating a financial plan through careful budgeting and saving. Once you have taken the time to determine your goals, you can sit down and look at your income and monthly expenses. Sometimes, it can take several months to get an accurate representation of how you spend money. You should carefully review your bank statements, credit card bills, and investments to see the bigger picture of your finances.

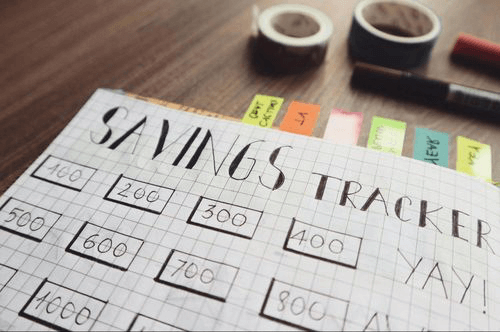

On an important note, budgeting is not as simple as sitting down once to create a plan. A good budget should be revisited on a regular basis, so you should continually reassess your cash flow and reevaluate your goals. As you continue to work towards and achieve some of your short-term financial goals, you can begin to put other goals in place and make moves toward your long-term financial goals.

Some of the most successful budgeting and savings strategies include:

- The 50/30/20 Rule: With this budgeting rule, 50% of your income goes towards your necessary living expenses (rent, utilities, and groceries), 30% goes to wants, and 20% is allocated for savings or debt repayment.

- Automated Savings: Consider having a percentage of each paycheck deposited into a high-yield savings account every month. If this process is automated, you are more likely to retain your savings, which can allow your money to grow over time!

- The 70/30 Rule: Another budgeting and savings method is the 70/30 rule of personal finance, which tells you to use 70% of your income to deal with living expenses. The remaining 30% of your income should be used to save or invest. If you are currently dealing with a lot of debt, this may not be the best option for your finances.

Overcoming Obstacles to Achieving Financial Goals

Achieving your financial goals takes time, careful planning, and a good deal of dedication. There are many obstacles that individuals face regularly that can stand in the way of them achieving their personal financial goals. Some of these common challenges include:

- Lack of Planning: Careful planning and preparation is key! By carefully monitoring your incoming and outgoing expenses over a period of time, you can create an accurate budget. If you don’t make a plan for your money, you are essentially wasting an opportunity to stay on top of your finances.

- Lack of Specificity: Review the SMART goal steps and ensure that you are incorporating this strategy into your financial planning! Not being specific enough with numbers or a timeframe for your objectives can derail any goal.

- Unexpected Expenses: Medical bills, home repairs, or a change in your employment situation can have a significant impact on your budget. Unexpected expenses and bills can create setbacks if you do not have an emergency fund to deal with them.

- Debt: It is important that you learn how to manage your debt and incorporate debt repayment strategies into your current budget. Learning how to borrow responsibly and understanding the different methods for debt repayment can help you to make long strides toward your goals. If you don’t deal with your debt, it can easily become an obstacle.

- Impulse Spending: The average consumer spent around $282 per month on impulse purchases in 2024. This amount can add up over time! Learning more about your spending triggers and becoming aware of your spending habits can help you reduce impulse spending.

The good news is that most of these challenges can be overcome with the right mindset and effort! Increased awareness of your spending habits and shortcomings can help you make more proactive plans to manage your finances and achieve your goals.

Tools and Resources to Help You Succeed

If you are a beginner when it comes to managing your finances, do not be intimidated! There are a variety of resources available to individuals that can help you succeed in your journey to better financial planning.

If you are searching for financial planning tools or resources, consider the following:

- Check Out Your Local Library: You don’t need to spend money on books to get more information about financial goals and planning. Most public libraries will have a finance section with a variety of self-help books and magazines.

- Listen to Podcasts: Learn more about finances on your daily commute! Podcasts can be a great way to stay in the loop about how other people manage their money. Some podcast channels on YouTube will post their full podcast for free, so you don’t need to spend any money to tune in each week.

- Find Free Apps: Use your smartphone or tablet to download free financial planning apps! Apps such as PocketGuard, Goodbudget, and EveryDollar can help you learn more about managing your finances.

In addition to the options mentioned above, reaching out to a financial advisor and seeking professional assistance can also be helpful in these situations. A financial advisor can help you assess your spending habits, so they can be a solid resource for discussing and prioritizing your personal financial goals.

What is the #1 Rule of Personal Finance?

The #1 rule of personal finance is to spend less than you earn. If you are already at that point, you are on the right path! Remember that during this journey, you should reward yourself for setting and achieving your financial goals when you get there.

Celebrating milestones is important because it helps keep you as motivated as possible. Additionally, this celebratory period serves as the perfect opportunity for you to set a new goal and keep pushing forward.