3 Easy Steps to Apply for Fast Title Loans Online!1

Click or Call

The auto title loan process serviced by LoanMart is extremely fast and hassle-free. Apply over the phone or online in 5 minutes or less!3

Submit Info

Submit your documents by 2PM PT and you can get your cash the same day.3 With a qualifying vehicle and income, you could receive a competitive loan offer!1

Get Your Money!

Get money sent directly to your bank account, or pick up at a participating money transfer location near you.

Instant Phone Decision1 • Any Car, Any Year • High Approval Rates

What is a Car Title Loan Serviced by LoanMart?

With a car title loan serviced by LoanMart, you are using your vehicle as collateral to get a loan.1 Essentially, you are using your car's equity to qualify for the funds you need! As a secured loan option, car title loans can offer qualified borrowers a flexible approval process and a faster way to get cash.3

Title Loan Benefits

You Can Get Today.

Fast Cash

Get your title loan

approved in minutes.1

Competitive Interest Rates1

Competitive rates, flexible loan terms and affordable monthly payments.1

Keep Your Car

Keep driving your car while you repay your loan.5

Don't Pay Too Much for your Auto Title Loan

Use your car to get cash and keep driving it while you pay back your Car Title Loan.

Whether you prefer short-term loans or long-term loans, you have options! Vehicle-secured loans serviced by LoanMart offer financial relief with payments that are manageable - and you can repay your loan early, without any prepayment penalties!

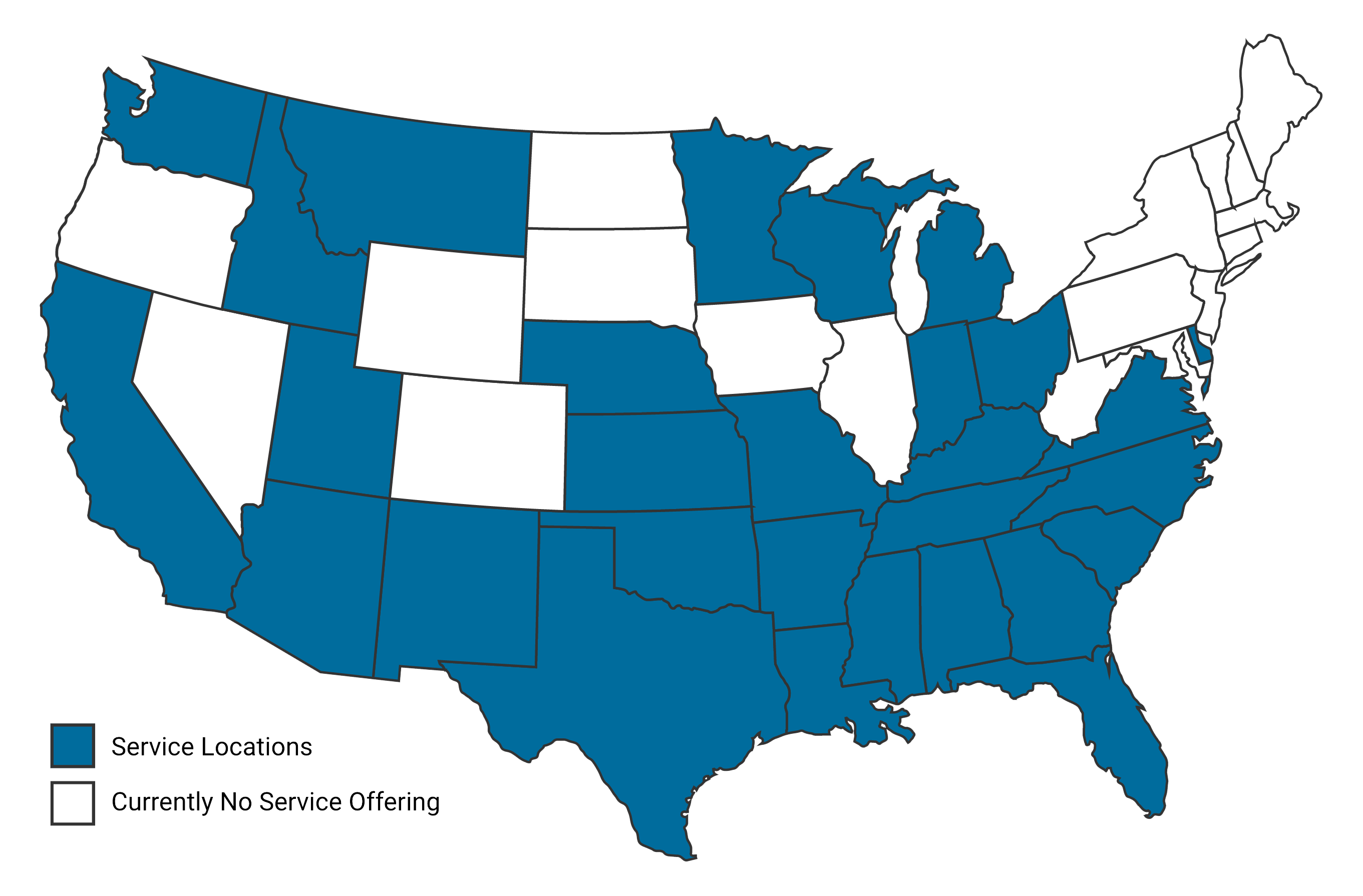

Title Loan Services Near Your Home

Learn more about the title loan locations we service and cash options near you.

1,300+

Metropolitan Areas Served

30+

States Served

300,000+2

Customers Helped

Why Choose LoanMart-Serviced Title Loans?

Facing a financial emergency can be tough. When life happens unexpectedly, finding the right loan option can be the key to getting through it and back on your feet.

Providing trusted and quality service to our customers has been our mission for over 20 years. You can expect compassionate loan officers and customer service agents that are available six days a week. Our whole team is committed to making your loan experience excellent. While you can apply and get approved online, real people are waiting to take your call today at 855-422-7412.1

Apply for a Title Loan Online Today

While many different loan options exist online, they may not be the best choice for your finances in the long run. Payday loans can come with very high interest rates, credit cards can come with low limits for cash advances, and personal loans are often only available to borrowers with strong credit histories. If you need fast financial relief, use your car's title to get access to cash you need - even if you have bad credit.1 Keep driving your car while you make on-time payments to your loan.

Get started on your car equity loan today by filling out our online application! The process to get a car title loan is fast and easy. Financial emergencies happen unexpectedly, and you need a loan that can keep up with your time constraints. Approved borrowers can get their cash in as little as one business day after approval!3

Customers Love Us!

Verified Testimonials